Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU. Income Tax Act 1959.

Advances In Taxation Pdf Free Economics Books False Book Portfolio Management

Accordingly the section provides that.

. 2 The individual is in Malaysia for less than 182 days in a. For the patent registered under the patent act1970 up to the amount of Rs300000 income tax can be saved. Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020.

And there are parts which have been customised to ensure adherence to the Act and Inland Revenue Board of Malaysias IRBM procedures as well as domestic circumstances. CBIC vide Q No. Amendments in Section 12A.

Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined. Income tax for the previous. 34 of circular F No.

That is Procedure for Fresh Registration. 354322019-TRU dated 7-5-2019 has clarified that the promoter can issue credit note under section 34 of the CGST Act and refund the amount with tax to the customer in case apartment is booked before 1-4-2019 but cancelled after 1-4-2019. A step-by-step guide with everything you need to know about filing your income tax returns form for Malaysia income tax 2020 year of assessment 2019.

1 The individual is in Malaysia for 182 days or more in a basis year. INDEPENDENT STATE OF PAPUA NEW GUINEA. Subdivision B Trading Stock.

However there is no such restriction under section 34 of the CGST Act. Charging section Section 4 of the Income-Tax Act 1961 is the Charging section of the Act. Income Tax Act 1959.

Get Returns as high as 15 Zero Capital Gains tax. An income tax rebate is calculated at the end section of your BE form after youve determined the amount of tax charged on your chargeable income. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019.

But after looking at changes made especially from the Taxation Laws Amendment Act 2019 to the CBDT instruction dated 11-May-2022 on implementation of Supreme Court decision in the case. Incentive under section 127 refers to the Income Tax Act 1976. Individuals and corporations are directly taxable and estates and trusts may be taxable on.

Tax rebate for self. It is only applicable to those who have incentives claimable as per government gazette or with a minister. Income Tax Act 1959 No.

Income Tax - Earlier the author believed that we do not need a direct tax code and appropriate amendments to the Income Tax Act 1961 will do the needful. Save upto Rs 46800. Section 7 of the Act sets down 4 circumstances of which an individual can qualify as a tax resident in Malaysia for the basis year for a year of assessment.

The CBDT or Central Board of Direct Taxes has announced the Finance Act 2018 wherein it has amended the Income Tax Acts Section 18. Nonresidents are subject to withholding taxes on certain types of income. Unlike 10 in Mutual Funds.

Under section 80RRB the tax deduction is applicable on the income earned by way of royalties and patents. Best Tax Saving Plans. Subdivision A Assessable income generally.

Condition for Applicability of Section 11 12 - effective from 01042021. After section 12AA of the Income-tax Act the Section 12AB shall be inserted with effect from the 01042021. The rates are prescribed under the finance act of every assessment year.

In Tax under section 80 C. Subdivision C Business Carried on Partly in and Partly out of Papua New Guinea. Under section 80U of Income Tax.

Key points of Malaysias income tax for individuals include. Other income is taxed at a rate of 30. The due date for filing income tax return for individuals is July 31st with few exceptions where for AY 2021-22 it is Jul 31st 2021 Dec 31st 2021 due to COVID-19 pandemic and other technical issues faced by IT Dept.

In case you havent filed your return before Jul 31st you still can file your return with EZTax through self-service or assisted service but filed as. After clause ab a new clause ac has been inserted. If your chargeable income after.

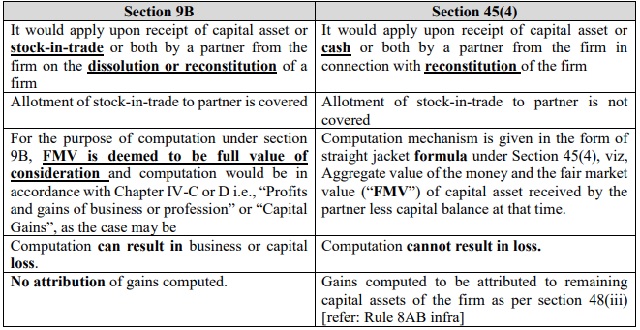

Redesigned Taxation On Reconstitution Dissolution Of The Firm A New Jeopardy Capital Gains Tax India

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

The Savemoney My Property Transaction Costs Estimator Work From Home Business Transaction Cost Tv Moms

Esos What You Need To Declare When Filing Your Income Tax

Aggregate To Total Income Acca Global

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

All About Tax Audit Under Section 44ab Of Income Tax Act Ebizfiling

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Tax Planning On Rental Income Afc Chartered Accountants Audit Tax Advisory And Accounting

Chapter 6 Business Income Students 1

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Section 194r Of The Income Tax Act Brief Analysis Enterslice

Different Types Of Income Tax Assessments Under The Income Tax Act

Flowchart Final Income Tax Download Scientific Diagram

Financing And Leases Tax Treatment Acca Global

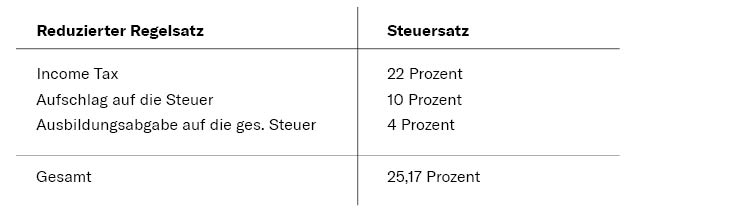

Indiens Steuerrecht Auf Die Details Kommt Es An Rodl Partner

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download